May 29, 2018. By Alex Colosivschi

Car dealers and second tier OEMs face an uncertain future.

On one side, large OEMs, inspired by Tesla’s success in establishing a direct to consumer car sales model, cult-like following, and an awe inspiring relative market capitalization of $48 billion (GM's currently is at $53 billion), are looking for ways to build their own direct to consumer channels.

On the other side, the mega fleet owners / operators like Uber, Lyft and Waymo pose an equal if not greater threat to both car dealers and smaller OEMs. The OEMs risk being disintermediated from their customer base and become brandless commodity providers of cars to an oligopoly of fleet managers. In this scenario only the largest OEMs will survive not dissimilar to the way Boeing and Airbus dominate commercial aircraft industry today.

For car dealers this future looks equally disconcerting as mega fleet owners will likely:

(i) Purchase cars in bulk directly from the OEMs (i.e. lower/no sales commission income)

(ii) Finance these purchases off their massive balance sheets (i.e. lower/no financing fee income), and

(iii) Either do maintenance services in house or contract them to a few, low cost maintenance mega service providers (i.e. lower/or no car maintenance income).

If you think this future is distant and improbable, consider the combined (and rapidly growing!) market capitalization of Uber, Lyft and Waymo today – an estimated $117 billion ($68B for Uber, $7.5B for Lyft and $41B for Waymo). To put that combined market capitalization in perspective it is already roughly equal to the combined market capitalization of GM, Ford and Fiat Chrysler of $131 billion ($53B for GM, $46B for Ford and $32B for Fiat Chrysler) as of May 29, 2018.

The size of the prize and the stakes are enormous with dramatic impact not just on dealers and OEMs, but the energy markets (over 60% of oil demand is used in transportation today), telecommunications (connected and autonomous cars are true data hogs far beyond what cell phones use) and machine learning / Artificial Intelligence (autonomous car development today is at the forefront of AI and robotics).

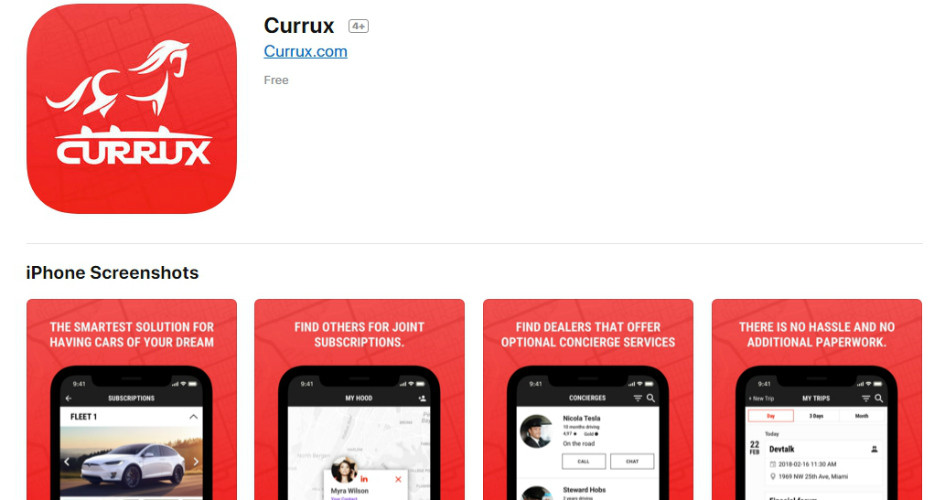

Enter Currux

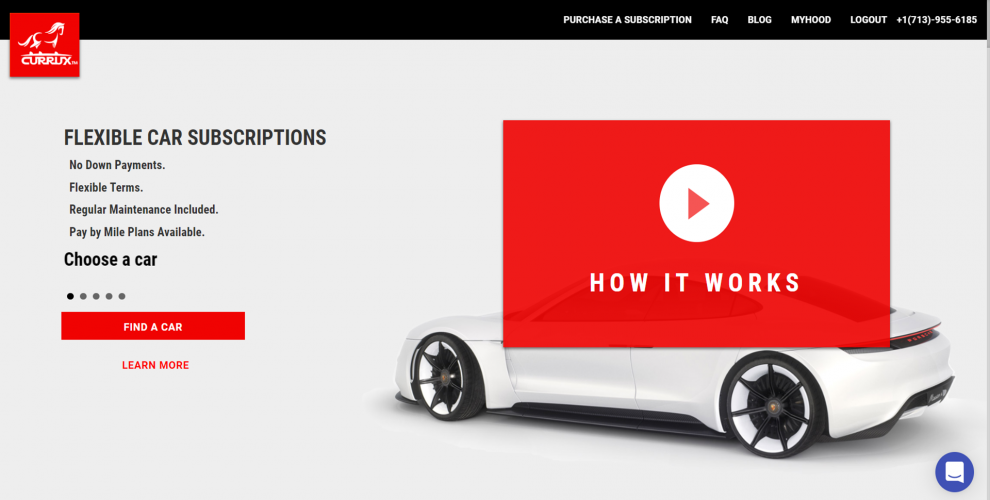

Currux was created to allow car dealers and second tier OEMs to take advantage of the trends described above and build a lasting new business line for the next 30 years.

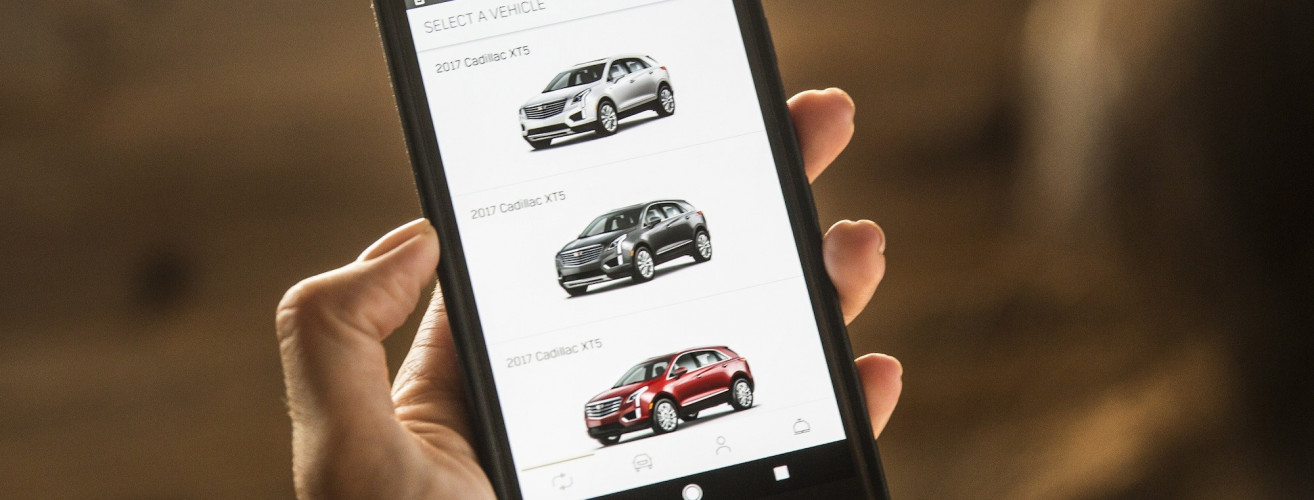

On one side Currux allows every participating car dealer and OEM to become a fleet manager by providing a platform and tools required to sell and manage fleet services.

On the other hand Currux creates for car dealers and OEMs a marketplace where individual customers can find and purchase fleet services/car subscriptions directly from fleet managers.

There are several important points here to consider:

(i) Currux does not disintermediate car dealers and OEMs from the individual customer. Rather we connect customers with the fleet managers.

(ii) Currux allows dealers and OEMs to build long lasting customer relationships via the subscription model which is focused on a recurring, monthly cash flow stream.

(iii) Currux allows dealers and OEMs to generate additional recurring (sic!) revenue by selling (re-selling) such benefits as insurance, maintenance and Concierge services based of our fleet software.

(iv) Currux constantly invests in and is solely focused on the fleet management software and technology thus making sure our participating dealers and OEMs can compete with the large players.

(v) Currux advertises the market place and participating dealers and OEMs thus eliminating the need for car dealers and OEMs to advertise their fleet management services.

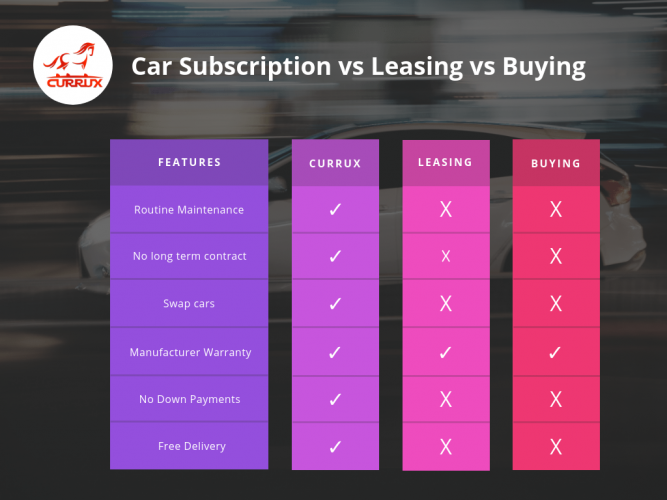

Why go with subscriptions?

Car dealers and OEMs should consider subscriptions for a number of reasons:

1. This is a recurring income stream.

2. Fleet managers keep the customer for the duration of the subscription period.

3. Fleet managers can sell other highly profitable monthly services such as Concierge, maintenance and insurance during the duration of the subscription period.

4. Customers, especially Millennials and younger are likely to increasingly demand the flexibility and convenience of both digital shopping and car subscriptions vs. traditional sale and lease models / process.

5. Subscriptions are complementary to car sales and leasing meaning car dealers don’t need to sacrifice their existing sales channels in order to be able to offer car subscription / fleet management services.

6. Subscriptions can generate a new pipeline of trade-ins by subscribing customers.

7. Subscriptions can lead to sale of the fleet vehicle to the customer after the subscription term expires.

How do I make money? Do I make money doing this?

First, let us reiterate that the combined market capitalization of Uber, Lyft and Waymo is estimated at $117 billion. Therefore, the short answer is Yes. There is money in fleet management.

Currux has built a financial calculator (available to participating dealers) that allows car dealers and OEMs to easily estimate their Return on Equity (ROE) Investment by offering subscription services on Currux.

For example, Currux estimates that our participating fleet managers can realize annual ROEs in 10 – 30% range before offering Concierge services and >60% with Concierge service included. This assumes 80% of the fleet capital cost is financed with 6% bank debt/floor plan and 20% is financed with fleet manager equity.

How do I finance my fleet?

The good news is that car dealers and OEMs are highly proficient in debt/lease financing of new and used vehicles. The bad news is that fleet management financing is somewhat different from traditional automotive financing structures (except for car rental companies).

There are several alternatives that fleet managers can explore as their business expands and depending on subscription terms they choose to offer:

1. Early stage: less than 50 cars in fleet. We expect most fleet managers to finance at this stage with cash on hand and working capital facilities already available to them.

2. Growth stage: 50 – 500 cars in fleet. At this stage we expect most fleet managers to partner with one of their floor financing partners or commercial banks in order to finance a pool of fleet vehicles under a term loan / revolving credit facility structure.

3. Mature stage: 500 + cars in fleet. At this stage we expect fleet managers to be able to syndicate pools of cars / fleets to various banks and financial institutions not dissimilar to the way mortgage pools are financed in capital markets today.

With fleet financing in mind, Currux built a state of the art automated credit check system that allows fleet managers to obtain auto loan credit score and reports of its subscribers. Thus, for any pool of vehicles/fleets, fleet managers will be able to provide to their financing institution the average credit score of its subscribers.

Currux is actively working with several financing providers in order to offer our participating fleet managers a turn-key fleet financing solution as well.

If you have any further questions about Currux please consult our FAQ section (https://currux.com/faq) or feel free to reach out to us using the LiveChat, our email (admin@currux.com) or phone number (713-574-2240).

Our head office is based in Houston.