These days we are subscribing for literally everything… subscription economy anyone? For example, from music subscriptions to food and now even cars.

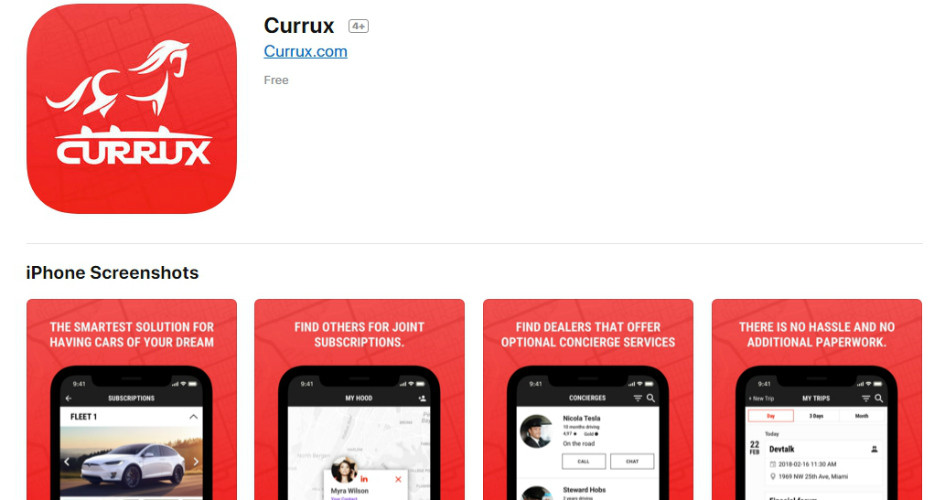

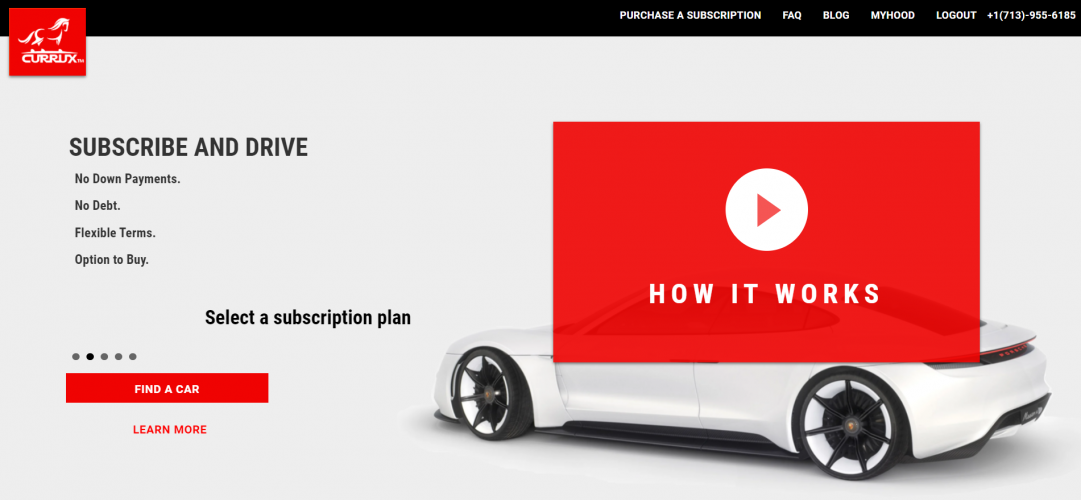

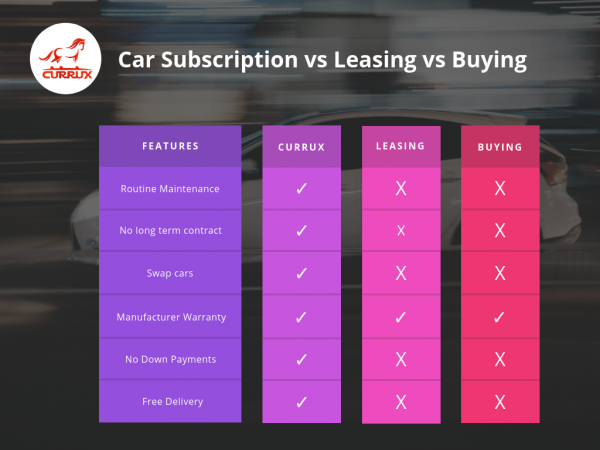

Usually, if you want to get a car, there are two ways to get one: Buy or lease. Now there's a third alternative: car subscription services, like Currux.com.

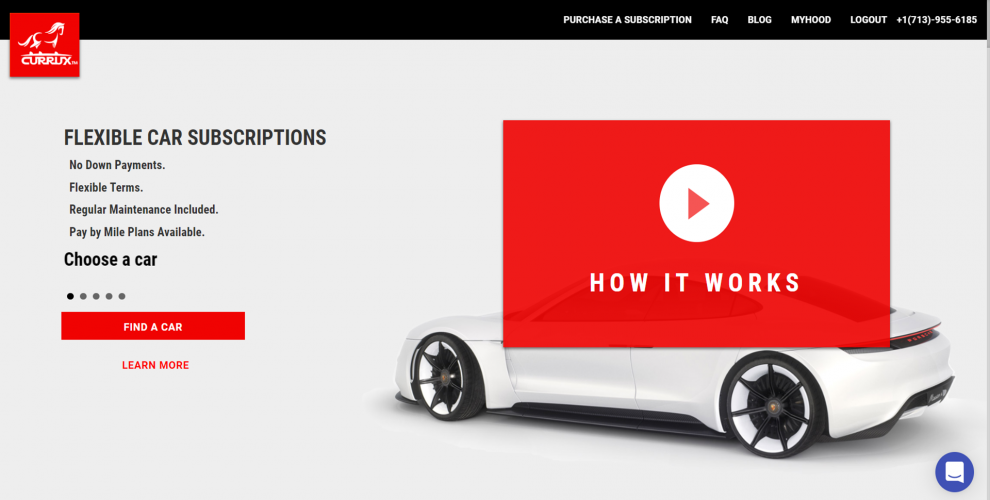

We are operating in Houston, TX, with the goal to launch in a number of places within the U.S. Currux car subscriptions offer an exciting opportunity. For a monthly fee that includes maintenance, insurance, and registration you can drive a car, usually without a long-term contract.

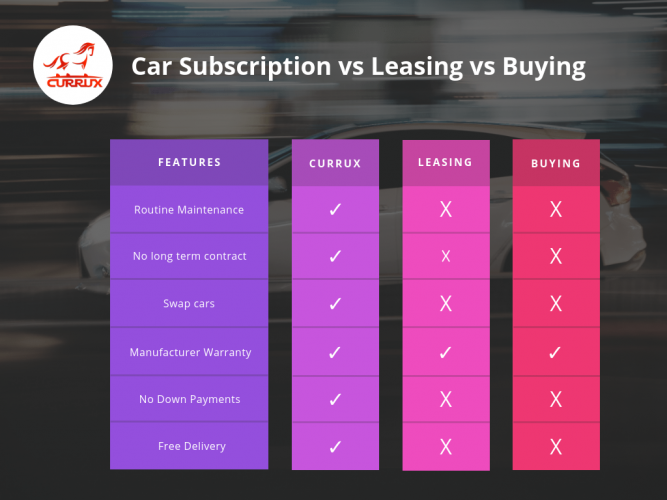

Let's take a look at a comparison chart of the features and qualities of these three models.

As far as car subscriptions go, it's by far the most cost-effective.

A few more details about subscriptions:

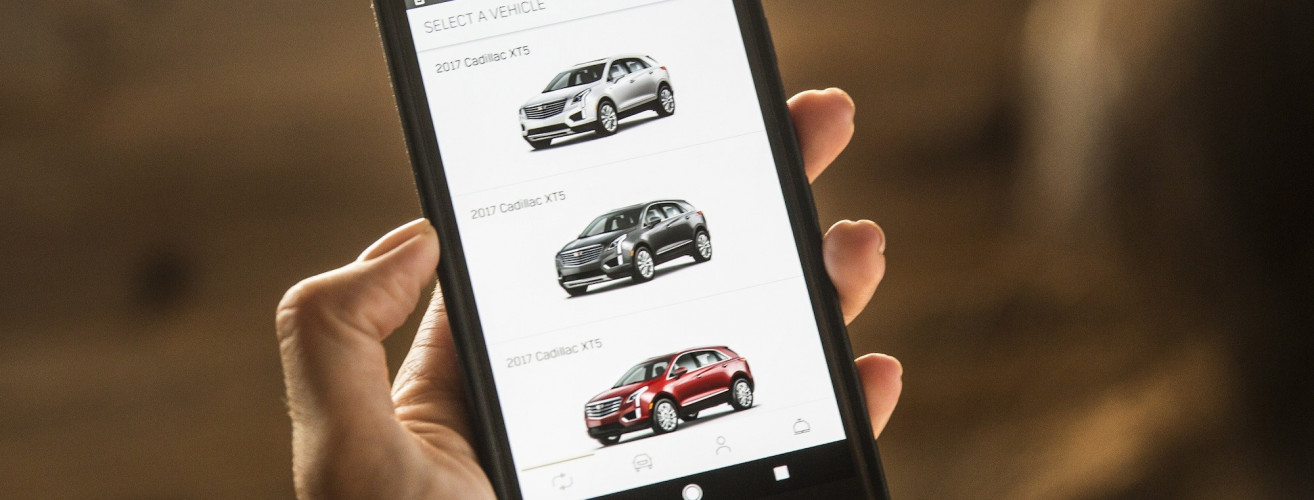

Flexibility. You can change cars more frequently compared to leasing or buying.

Convenience. You can set up the subscription online and manage it via a website and smartphone app.

No hidden fees or surprises. No negotiating. The fees are set.

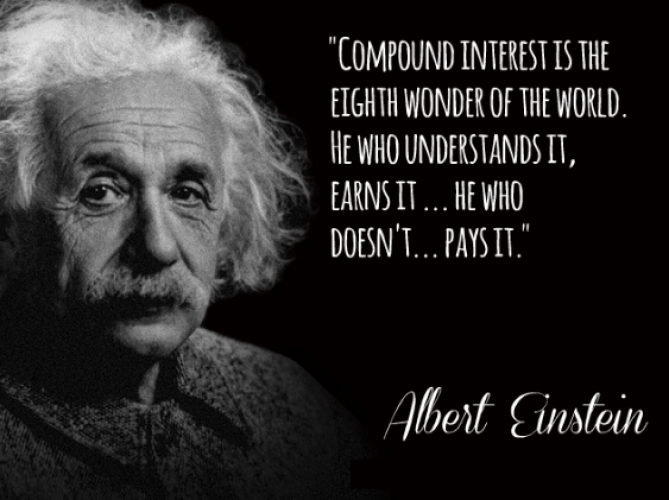

Potential cost savings. There are no down payments or an increase of charges.

Less commitment. Currux subscription services can be for as short as one month.

Credit score. It's easier to get a car subscription than getting approved for a car loan or leasing it.

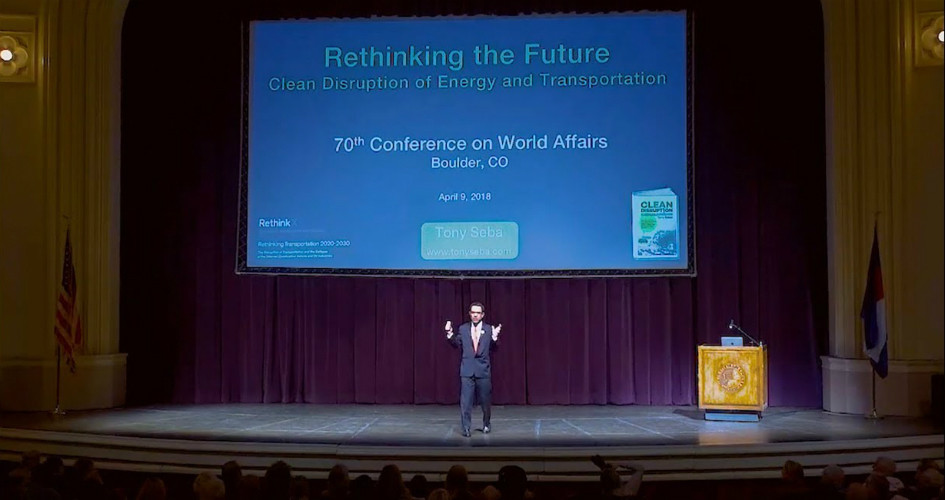

Statistics and forecast

By 2026, car subscription programs could account for nearly 10% of all new car sales in the US and Europe. Throw in predictions of over 16 million cars being part of car subscription services by 2025, and of 1 in every 5 cars in a subscription offering being new and it comes as little surprise that everyone—car manufacturers, automotive dealership groups, car maintenance, repair companies, insurance firms, technology startups, AI companies, lending companies, concierge operators, and most importantly, the customers—are passionately enthusiastic at what appears to be a financially benefiting ever-expanding pie.