Nicole Casperson, September 17, 2018 Credit Performance, Innovation & Mobility

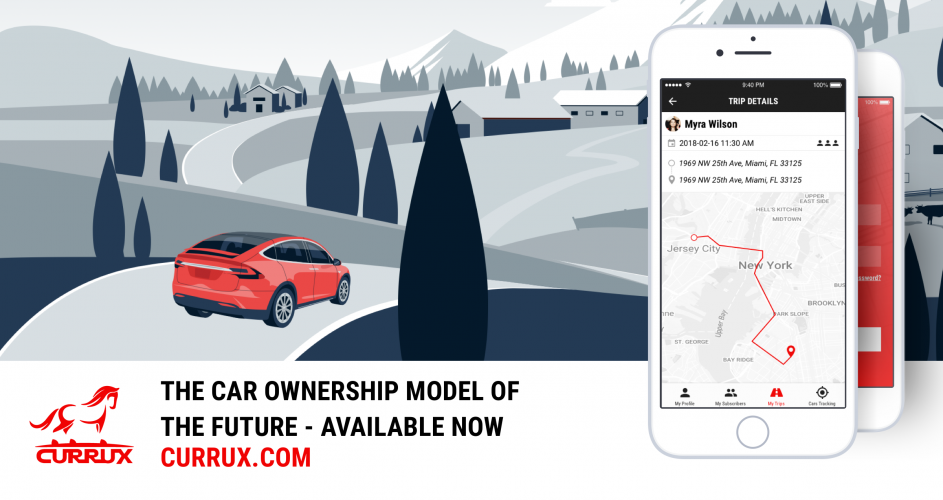

The depreciation of a new vehicle and its hidden costs for consumers could drive the market further toward subscription services.

“The market today is in good time [for consumers] to think about [subscription services] as an alternative,” Jonathan Banks, vice president of vehicle valuations and analytics at J.D. Power, told Auto Finance News.

Depreciation can account for around 40% of the cost of owning a new vehicle, or about $3,000 a year, making the length of car ownership as valuable as the sticker price, according to AAA’s 2018 “Your Driving Costs” study, noting that the most significant expense of purchasing a new car is, in fact, depreciation.

However, consumers fail to take depreciation into account as consumers typically focus more on getting a good deal off the bat. “But, car owners that like to change vehicles frequently should be thinking about the resale value – not just the purchase price – when choosing their next ride,” said John Nielsen, AAA’s managing director of automotive engineering and repair, in a press release.

Subscription services benefit the consumer by providing a “short window of time to own a vehicle,” Banks added. “When I look at where the market is, we’ve hit a point that offers itself well to subscription services.”

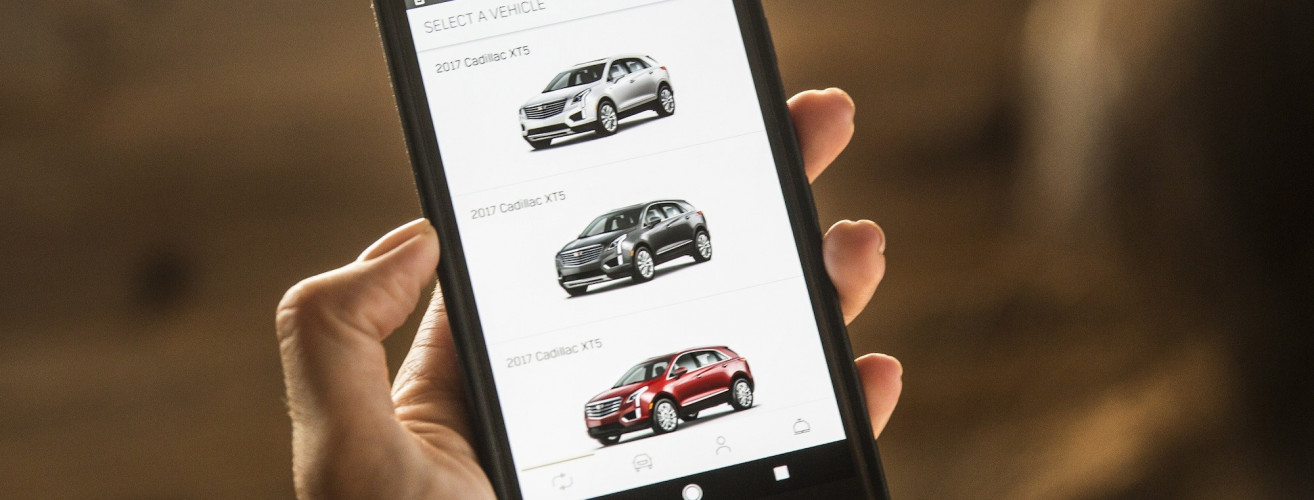

Used-vehicle leasing app, Fair, is capitalizing on this depreciation cost by providing an alternative to long-term financing with its subscription model.

“We aren’t lending consumers money to borrow an asset that is going to depreciate,” Scott Painter, chief executive of Fair, told AFN. “We give [consumers] the ability to have a car without the complexity of ownership. Why get a loan for an asset that’s just going to depreciate?”

The depreciation of vehicles in the market today is influenced by some factors, AAA notes, including the shift in consumers’ preferences to SUVs and pickup trucks compared with sedans, as well as greater acceptance of electric vehicles.

Due to changing consumer taste in favor of SUVs and trucks over sedans, the depreciation costs for sedans increased year over year to 13%, AAA finds. Meanwhile, electric vehicles are growing in popularity with 20% of consumers saying they’d consider electric vehicles for their next purchase compared with 15% of consumers a year ago. EVs could provide consumers with other costs benefits such as lower refueling costs, repair, and maintenance bills, AAA says.

After calculating for the cost of fuel, maintenance, repairs, insurance, license/registration/taxes, depreciation and loan interest, AAA found that the average price to own and operate a new vehicle in 2018 is $8,849 per year.