Eighty percent of premium car drivers intend to switch to an electric vehicle within the next five years By Graeme Roberts Eighty percent of premium car drivers in Germany intend to switch to an electric vehicle within the next five years, according to a survey. The majority (66%) would finance the vehicle rather than buy it outright. This was the result of a recent Kantar survey on behalf of Mercedes-Benz Mobility among 2,500 drivers across various brands in Germany, the US and China. In all countries, preferred providers when switching to an EV are the manufacturers’ financial service providers (worldwide 73%, 81% in Germany, 74% in the US and 64% in China), the automaker said. Digital offerings are increasingly popular. Online contact with the provider is increasingly important and considered equally important as personal contact for the majority of respondents. The most open market for in car payment was China (46%) where potential users considered this service a key competitive advantage of a provider over other providers. According to the study, financing was still the preferred option (46%) among all financing options, followed by car subscriptions and vehicle leasing. 45% of respondents said manufacturers’ financial service providers (captives) played a significant or even very significant role in deciding whether to remain loyal to a brand. Mercedes-Benz Mobility chairman Franz Reiner said: “We perceive a clear push towards e-mobility and a desire for more financial flexibility among car drivers. “The study thus confirms our strategy of paving the way to green mobility with flexible financing options. The digital sales channel is playing an increasingly important role in this, but personal advice remains relevant.” German, US owners prefer finance to purchase In all three markets, a large majority of respondents could imagine driving an electric car within the next five years with China standing out with 96%. Germany (80%) and the US (68%) followed. There was also a strong interest in financing options – of respondents interested in electric cars, 66% German and 65% American said they would purchase the vehicle via a financial product (financing, leasing or car subscription). Direct purchase is much less popular with 44% in Germany and 45% in the US. The most popular financing option in all markets is financing (GER: 48%; US: 60%, CN: 58%). When it comes to financing and leasing an electric vehicle, the manufacturer’s financial service provider was the first choice in all countries. In Germany, 81% opted for captives followed by the US (74%) and China (64%). Online purchase increasingly popular, respondents open to in-car payment For the majority of respondents in all countries, digital touchpoints with the provider during the purchasing process were as equally important as personal contact with the dealer (GER: 55%; US: 52%, CN: 76%). The willingness to finalise a financing or a leasing contract or car subscription online wass also more distinct than an online direct purchase. However, a designated personal contact can increase the willingness to finalise a contract online. In Germany, for example, around a third (38%) of respondents stated they would not finalise a financing or leasing contract online without personal advice. However, around half (47%) of these individuals would be willing to finalise an online contract together with a personal advisor. In China, on the other hand, only a quarter (26%) would decline an online-only contract for financing and leasing. However, two thirds (67%) of these respondents would be willing to finalise the contract online together with a personal advisor. Particularly in China, respondents are open to digital payments from the car (in-car payment). In China, 46% of the study participants would very likely or even definitely use in-car payments. In Germany (27%) and the USA (27%), there are still concerns about data security and data protection. However, those may be reduced through raising awareness about the security of the system. Potential users in all countries rate in-car payment a key competitive advantage of a manufacturer over other providers (GER: 55%, USA: 68%, CN: 76%). The study participants consider the significant gain in convenience and more ease in everyday life the greatest advantage of in-car payment. Financing still the top option To finance their next car, 46% of respondents would opt for financing. This is followed by subscription (32%) and leasing (26%). Users who financed or leased their current car would choose financing options again for their next vehicle. Direct purchasers in Germany and the US tend to purchase their next car again directly, as well. In China, direct purchasers are showing greater openness to different financing options: the willingness to switch from a directly purchased car to financing or a car subscription is most significant here. Thus, 48% and 51% of Chinese respondents respectively would very likely or even definitely switch to financing or a subscription model for their next car. In Germany, this willingness is currently still low at 18% (financing) and 21% (car subscription) respectively. German drivers finance to own the vehicle at contract end “At the end of the contract term, the car will be mine” – this is one of the main reasons for financing a vehicle in Germany (46%) and the US (43%). Financial capabilities also play a role in all countries, especially China and the US. In the US, this includes the possibility to purchase an otherwise too expensive car (52%). In China, it means avoiding a high one off payment when purchasing outright (49%). According to the respondents, leasing in particular allows buyers to drive a new car more frequently (GER: 40%, US: 46%, CN: 26%). In addition, one of the main reasons cited was that age related repairs were easier to avoid (GER: 37%, USA: 49%, CN: 13%). Especially in Germany and China, study participants who only wanted to use the vehicle but not own it considered leasing attractive (GER: 37%, CN: 26%). Financial considerations tended to play a secondary role. Manufacturers’ financial services strengthen loyalty, majority opt for new car While the choice of a financial service provider in Germany and the US depends on terms and conditions, Chinese respondents attached even greater importance to receive all vehicle related services from a single source by a single provider. Trust in the provider was a decisive factor in Germany, US and China when choosing. The manufacturers’ financial service providers thus have a significant influence on brand loyalty: for almost half of the study participants (45%), the services provided by the financial service providers played a significant or very significant role in their considerations to choose a brand again. Financial service providers also contribute to further economically positive effects for manufacturers: in contrast to direct purchases, the majority of respondents in all three countries opted for more optional extras when financing or leasing a vehicle (62%) as well as for a new car instead of a used one (56%). Additionally, financing or leasing contracts led to the purchase of additional services, particularly in China (GER: 44%, USA: 45%, CN: 66%). Car insurance was popular in Germany and China, as were extended warranties in the USA. Market research institute Kantar surveyed 2,605 individuals from Germany, the US and China in an online poll on behalf of Mercedes-Benz Mobility between January and February 2022, Kantar surveyed drivers of premium cars across all brands who had acquired their current vehicle either by means of financing options (financing, leasing) or by direct purchase.

Germans lead EV buyer intentions poll

3 years ago

Share

You may also like

-

Electric Cars Could Save Ride-Sharing Drivers $5,200 a Year

-

Waymo starts to eclipse Uber in race to self-driving taxis

-

Driving in US Costs More than in Parts of Europe

-

Mercedes-Benz's Plan for Surviving the Auto Revolution

-

Self-Driving Car Pioneers Are Slowing Down After Crashes

-

Clean Disruption of Energy and Transportation - CWA - Boulder, April 9, 2018

-

Driverless car startup Drive.ai is launching a ride-hailing service in Texas

-

Cleantech Investors Should Put Their Money in Transportation, Says Village Capital

-

Car companies have started offering monthly subscriptions for drivers who don't want to own

-

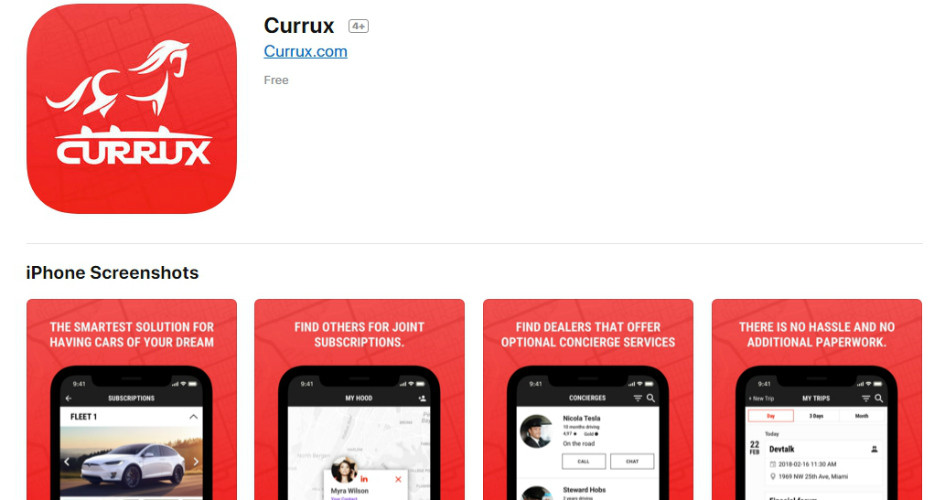

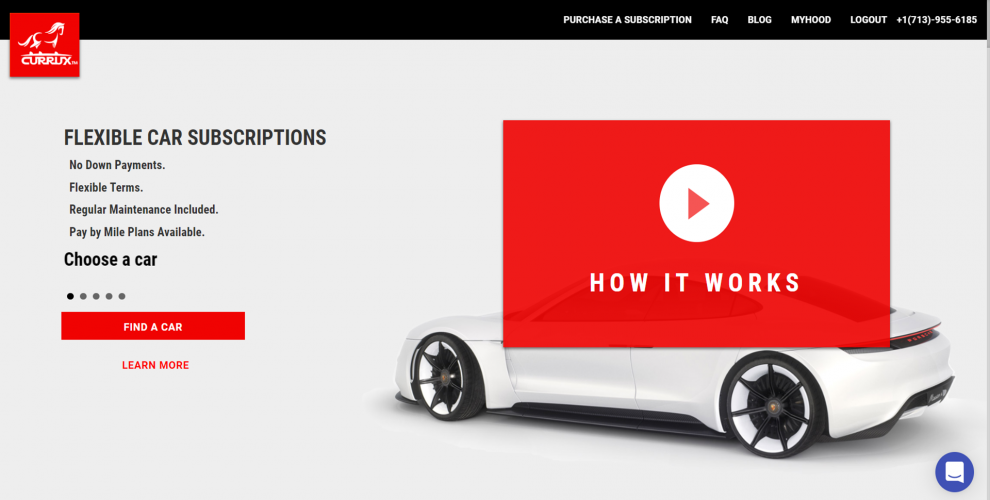

Introduction to Car Subscriptions / Currux

-

Currux App is Coming!

-

On Shared Car Subscriptions, the Power of Compound Interest and Currux

-

Currux App is now available on Google Play!

-

Mary Barra on Driving Into the Future

-

Currux – a case for a decentralized fleet management / mobility future.

-

Currux App Is Now Available on Apple App Store!

-

GM Gets Ready for a Post-Car Future

-

Currux - Interview with the developer of a fantastic app

-

Volvo targets 33% autonomous sales and 50% subscription sales by 2025

-

Why Buy a Car When You Can Subscribe in Style?

-

State bill would put car dealers in driver's seat for newfangled subscription services

-

Toyota Launches a Car-Sharing Subscription Service for Hawaii

-

New Age of Transportation Expected to Thin Auto Dealer Ranks

-

Car subscription services offer simple, flexible alternative to buying or leasing a car

-

Like Netflix or Amazon Prime for cars: St. Louis dealers look to lure customers with monthly subscriptions

-

Version 3 of Currux App Published in App and Play stores.

-

Riding Uber & Lyft More Expensive than Subscribing with Currux

-

This is What You Need to Know About Car Subscriptions

-

Monthly car subscriptions pick up speed with drivers

-

Increased Consumer Awareness of Depreciation Costs to Boost Subscriptions

-

With Audi Select, Automaker Pilots Subscription Rentals

-

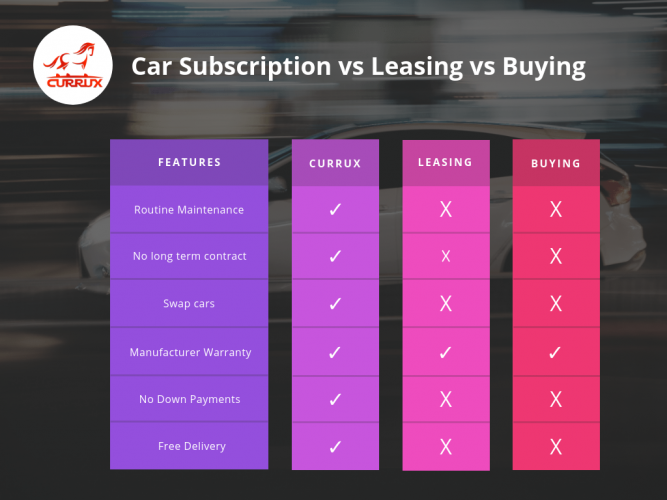

Difference between leasing and car subscriptions

-

Continuous EV Range Increases Will Drive US Shifts To Leasing/Subscriptions & Growth In The Used Car Market

-

Currux Car Subscriptions: 5 Things You Should Know

-

Leasing vs. Buying vs. Car Subscription

-

Audi Approves Mega Spending On Electric Mobility

-

WARMEST WISHES FOR HAPPY HOLIDAYS AND A HAPPY NEW YEAR!

-

One-Click Online Purchasing Is Encouraging More Car Buyers to Ditch the Dealership

-

Car subscription services: A slow, expensive start — but the potential is huge

-

Noteworthy way to get a cheap monthly car rental in Houston

-

This company’s machine learning programs are making driving in Houston safer — and cheaper

-

Eight trends that determine the future of vehicle leasing

-

AMAZON CONFIRMS HUGE INVESTMENT IN EV MAKER RIVIAN

-

COMPLETE GUIDE TO VEHICLE SUBSCRIPTIONS

-

Yes, You Can Lease a Used Car

-

Leasing a Used Car Can Save You Some Serious Bucks

-

Enterprise announces its automobile subscription service

-

Instead of leasing or buying a car, subscribe to one

-

Five ways vehicle subscriptions will impact dealerships by 2020

-

Private and SME Segments Stand Out Globally as Key Targets for Car Leasing Companies

-

Car subscription service Cluno discloses €140M in debt financing

-

Daimler Mobility starts long-term car rental business in Korea

-

Could car subscription services disrupt the auto industry?

-

Currux to Participate at Cleantech Private Capital Day v2 Investor Conference

-

NEWS Toyota launches European mobility brand Kinto

-

The Cruise Origin Story

-

Pay to play: Car-subscription programs on the rise

-

Used Car Leasing on Course To Becoming A $6B Market (And That’s Just In Europe)

-

Penske Offers Truck Fleets a "Get Back to Business" Special Offer with Flexible Lease Terms

-

OEM Transformations: The Benefits of Subscription Models

-

UK’s Drover raises $26M to take its car subscription marketplace to Europe

-

Those Vehicle-Swap Schemes Seemed Like a Good Idea

-

It's still Day 1 for vehicle subscriptions

-

Why OEMs Won’t Survive Transition to Mobility

-

Investors Are Eyeing Mobility Technologies, and for Good Reason

-

Edmunds: Whatever happened to car subscription services?

-

Tesla finally offers lease-to-buy options for Model 3 and Y, but it’s not available everywhere

-

Porsche adds the all-electric Taycan to its subscription program

-

Will The Shift To Electric Vehicles Change The Car Subscription Market?

-

Volkswagen Explores Customer Interest In Subscription Model

-

Currux featured as one of 22 Best Texas Based Consumer Lending Firms

-

Currux Review – Complete Review

-

Car subscription: a multi-billion Euro market!

-

Car Subscription Services 2.0: How to Win the Race

-

EVs and autonomy: Why it will make no sense to buy your own electric car

-

What is a car subscription service?

-

Autonomy’s Electric Vehicle Subscription Now Available in California’s Napa, Sonoma, and Marin Counties

-

Germans lead EV buyer intentions poll

-

Car subscriptions entering the vehicle market: What you need to know