John McElroy | Nov 02, 2020

Even though the early horseless carriages were made using the same manufacturing techniques as for horse-drawn carriages, none of the carriage companies made the transition to mass-manufacturing cars.*

That’s because once a company establishes a competence in a given area of business, it’s very difficult for it to transition into something else.

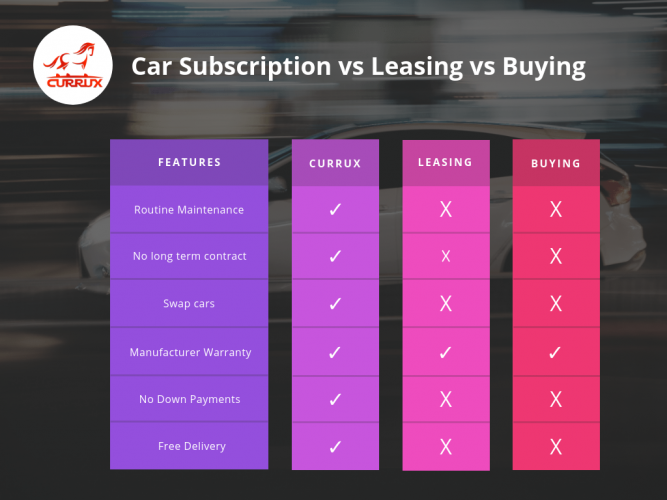

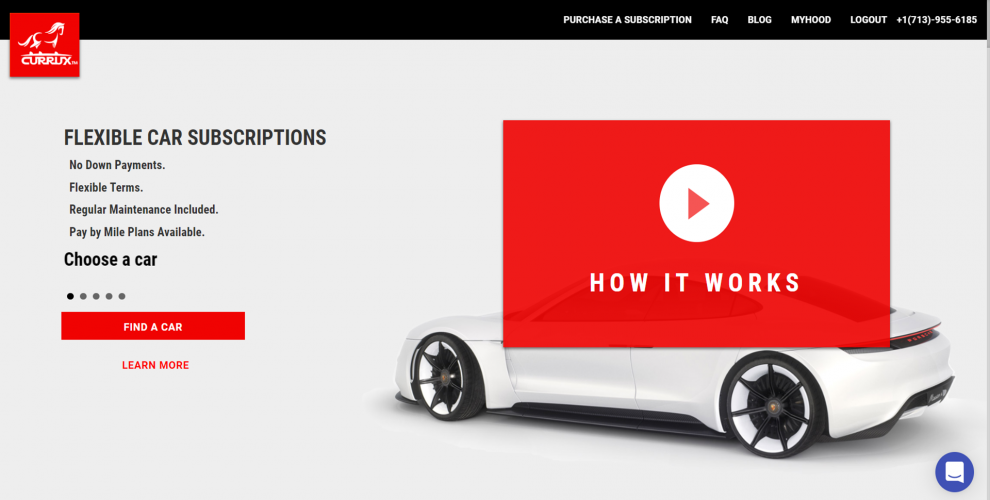

Today, the auto industry is in the early stages of transitioning to a world where mobility will be sold as a service. Instead of buying units (cars), people will buy miles (mobility). So all the major OEMs are trying to figure out how they play a role in MaaS (mobility as a service), but they don’t know how to do it.

General Motors launched a car sharing service called Maven that failed and shut down. Ford launched a ride hailing service using Transit vans called Chariot, which failed and shut down. Mercedes-Benz launched a sharing service called car2go, and BMW started one called Drive Now. Neither one was successful, so Mercedes and BMW merged them into a new company called Share Now. It failed and shut down.

Automakers are really good at designing, engineering, manufacturing and wholesaling cars. Pay attention to that last point, because it’s a critical one. Automakers are wholesalers, not retailers. They don’t have any retail experience. They sell cars to dealers, and they in turn retail them to customers.

Even though I’ve never met a CEO from a car company who had any retail experience, the factory people are really good at telling the dealers how they should run their business. They tell them what their stores should look like, right down to what color the tiles on the showroom floor should be.

All this makes the OEMs think they’re really good at selling – after all, the dealers buy whatever the factory tells them to.

But this mindset will not work in the retail world of mobility services. Not even for dealers. They don’t have the right mentality for selling mobility services, either. Haggling over prices and using stalling tactics like “Let me check with the manager” can’t compete with a phone app that delivers instant results.

Soon we’re going to see several OEMs jump into the mobility segment with shared, autonomous vehicles – robotaxis, as they’re often referred to. Tesla, which has a direct relationship with its customers since it doesn’t use franchised dealers, probably will thrive in this business. But the traditional OEMs are sure to fail unless they do it in a different way.

But if the solution to succeeding with mobility services is to let an outsider do it, where does that leave the OEMs? It means the car companies will become mere suppliers of vehicles for mobility companies.

The good news is, OEMs will continue to make millions of vehicles for years to come. But they no longer will be masters of their own destiny or of their industry. To use an automotive analogy, they’re not going to be in the driver’s seat.

https://www.wardsauto.com/industry-news/why-oems-won-t-survive-transition-mobility