Electric Vehicle and Private Car Leasing will continue to be dominant themes in the 2019 Global Fleet Vehicle Leasing Market. While we are waiting for the official results to be communicated by the major players in the market, we can already discuss about the car leasing market evolution, its trends and what the major influencing factors will be for the next period as well.

Frost & Sullivan finds that the two big themes that will dominate the market over the course of this year are electric vehicle (EV) leasing and private vehicle leasing. OEMs will focus aggressively on EV leasing and will position themselves as lessors, thereby encroaching into an area traditionally occupied by traditional lease companies. At the same time, the demand for private vehicle leasing, particularly full service operational leasing, will continue to grow strongly. For 2018, the global fleet leasing market is expected to report a growth of 5.3%, driven by demand from operational leasing which is expected to account for 30.3% of the total company cars sold.

The forecast for the overall company car market registrations shows an ascending trend from 2018 through the next couple of years as well. Following the ascending trend for company car registrations, operational leasing will also continue to grow. The main influencing factors that are expected to impact the fleet leasing market, next to Private Leasing and Electric Vehicles are detailed below:

OEMs focus aggressively on EV leasing

EVs are becoming the go-to option for environmentally conscious consumers who want to reduce their carbon footprint. As demand rises, leasing will become the preferred route to accessing EVs. This will be due to two reasons: first, EV cars depreciate faster than their internal combustion engine (ICE) counterparts and, therefore, leasing helps customers avoid the pitfalls of low resale value and, second, leasing will allow customers to change their EV models more often, an attractive proposition since new EV models with progressively sophisticated features are being launched with regularity these days.

EV leasing, covering both EV and hybrid EVs, is expected to post a growth of 12.9% in 2018, hitting a sales volume of over 170,000 units. Paralleling this, OEMs will start to position themselves as lessors. Rather than focus solely on outright sales, they will also start selling EV lease contracts directly to customers. As this happens, they will increasingly edge out traditional lease companies, representing an opportunity cost for the latter. Already, Tesla and BMW, among other OEMs, are evaluating the value of various leasing models.

Multiple benefits drive appeal of Private Leasing

Private leasing is estimated to post a growth of around 4.0% in 2018, registering a strong performance in Europe and North America. In Europe, alternatives such as cash in lieu and mobility budgets are motivating company car holders to opt for more flexible lease solutions like those offered by private lease. In the US and Canada, private leasing is receiving impetus from a young population which favors this form of leasing due to the benefits it offers including easy, hassle-free usage and fixed mobility costs.

Used Car Leasing gives old cars a new ‘lease’ of life

With an estimated addressable market of over 12 million units in 2018 (number set to increase even more in 2019), used cars are now big business for the leasing market. Old cars are receiving a new ‘lease’ of life with several leading lease companies including LeasePlan, Arval, Ally, and Orix already in the active in the space.

While a sizeable supply of used cars come from lease/rental companies, especially in the US and Europe, options continue to be limited. Question marks also persist over whether used car leasing will experience more maintenance issues typically associated with older cars. However, lease companies are confident that this will not be the case; due to improvements in predictive maintenance technologies, such cars are better maintained and have a solid servicing record.

SME Leasing - significant untapped potential

Fleet leasing has transitioned from a service that targeted principally large corporates to embracing small and medium enterprises (SMEs). This is not surprising considering SME leasing offers huge, untapped potential of over 27 million cars. Leasing companies have already begun investing in units that specifically focus on leasing solutions for the SME segment. Through 2019, lease companies are expected to continue to leverage digitization, customization and online channels to aggressively target SME customers.

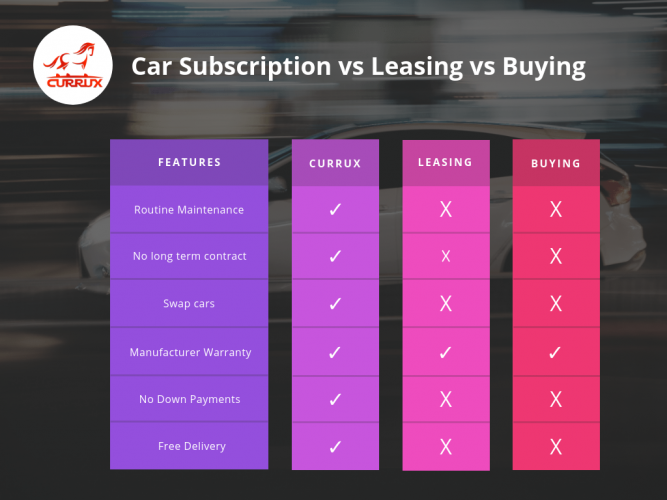

New Mobility-as-a-Service models pose competition

While there’s a lot to be optimistic about, leasing companies also need to gear up for key challenges that are likely to come their way in 2019. In addition to car sharing, mobility budgets and private leasing, the emergence of subscription services is also creating some unease in the leasing industry. With their potential to lure away company car users, these innovative and flexible mobility solutions are taking the fight to the fleet leasing industry.

Car-subscription services rise in popularity

Subscription-based mobility services, in particular, have gained tremendous appeal, beguiling customers with their promise of simplicity and flexibility. While some early pilots have folded, Ford’s Canvas, Cadillac’s Book, Porsche’s Passport, Care by Volvo and Hyundai’s Ioniq Unlimited highlight the continued potential of subscription services. They allow customers the option of on-demand services—akin to Netflix and Hulu—and without any long-term commitment, unlike leasing. These services also allow customers to change vehicles based on their requirement, or pay varying amounts according to the type of car they use.

Implementation of IFRS 16 to create uncertainty

The implementation of the International Financial Reporting Standards (IFRS) 16 will impact the leasing market in 2018-2019, creating a burden on operational lease customers. It will lead to operational lease being considered an asset and being accounted for both in the customer’s balance sheet and income statement. This has created confusion in the market with increased burden on customers in migrating to this new legislation. Lease companies are partnering with audit firms such as PwC to support customers in making a seamless transition.

Digitisation

The vehicle leasing value chain is being transformed by process innovations and new technologies. Lease companies will continue to leverage digitization in order to provide cost-effective and instant services to customers. Blockchain technology is set to be an important catalyst in this transformation. While still in the early stages, technology companies and payment service providers are partnering to implement blockchain-based retailing and leasing platforms.

While significant challenges will persist, 2019 will be an exciting year for the fleet vehicle leasing market with new products and services, segments and business models driving opportunities for growth.

Image: Care by Volvo is just one of the growing number of subscription-based mobility services.

Author: Octavian Chelu, Principal Consultant Fleet & Leasing, Frost & Sullivan