By Eric Zayer, Mary Stroncek, Thomas Wendt, Klaus Stricker, and Raymond Tsang At a Glance Despite the hype, many companies have had trouble developing profitable car subscription services. But it’s possible, if a company finds the right mix of contract terms, vehicle age, and price. Emerging subscription leaders are avoiding common pitfalls, sharpening operational capabilities, steering customers toward used and electric vehicles, and involving their partners along the value chain. Despite the hype, companies have struggled to turn car subscription services into money makers. Nevertheless, there’s a strong argument to pursue them anyway. First, it’s becoming clear that subscriptions in some form will likely emerge as one of the future pillars of car ownership. In a Bain & Company survey of 1,500 automotive consumers last year, 64% of Chinese consumers said they were likely or very likely to consider getting a car subscription with their next vehicle purchase, as did 30% and 21% of respondents in the US and Germany, respectively. Although the ultimate size of the subscription services market remains up for debate, it will most likely make up a significant share of car sales in the future. But regardless of the market’s size, developing a winning subscription offering will be an important strategic step, especially for automakers, for several reasons. It’s a defensive move for automakers to protect market share that car rental companies and start-ups are trying to capture. It’s a promising outlet for marketing used and electric vehicles, which are popular among consumers considering subscription services, according to Bain’s 2020 survey. It can help win new customers. It will help automakers understand their customers better and strengthen relationships with them. That should help turn more of them into repeat customers and create upsell opportunities. It keeps customers in the automaker’s aftersales and services network, which would strengthen the company’s relationships with its dealers and potentially expand its profits. It could lead to new revenue streams, such as insurance offerings. It can build automakers’ digital muscles and provide an entry into direct-to-consumer businesses. The Covid-19 pandemic has provided an opening for companies to hone and scale up their vehicle subscription offerings. The majority of consumers in the US, Germany, and China say these services are more attractive during an economic crisis, according to Bain’s survey. The takeaway: When many people aren’t willing or able to buy or finance a new car, they consider a subscription service less risky. Now, the question is: What does a winning subscription model look like? The offerings to date have struggled to gain traction because they’ve mostly involved new cars and often have very flexible contract terms—such as the option to frequently change vehicles—which implies a high cost for the provider. The result? A niche product that’s prohibitively expensive for most consumers and difficult to operate profitably. But there’s a path to profitability for car subscription services. The key is to recognize a handful of common misconceptions about the sector and redesign the subscription service accordingly. We believe three business models will deliver the most value and emerge as the winning options in the coming years. These models are more narrowly focused and not as radical as the original vision that garnered so much hype. Nevertheless, they have the potential to be a solid business with strategic importance for the company. The key to car subscription services 2.0 is to strike the right balance between consumer preferences and financial feasibility across the following elements: the length and flexibility of the contract; the ability to switch vehicles (or not); the age of vehicles offered; and the pricing models. Misconceptions hold subscriptions back Automakers and their competitors recognize car subscription services’ potential, for both their businesses and the future of car ownership. But a number of misconceptions about what works in a car subscription model have held these services back. 1. Subscribers want a brand-new car. In reality, the vast majority of consumers are open to driving a well-maintained, young (up to three years old), used car through their subscription, according to last year’s Bain survey. Fewer than 15% of consumers in each country said they’d accept only a new car (see Figure 1). 2. Customer preferences are consistent everywhere. Actually, consumer preferences vary between countries and within them, making it difficult to create a one-size-fits-all model. For example, US and Chinese consumers consider a low subscription price the most important factor, while Germans’ top preference is flexibility of the car return (see Figure 2). Duration: Some consumers look for a shorter subscription (e.g., less than six months) because they just want a vehicle to bridge the time between owning cars. Other consumers treat a subscription as a more flexible way to own a vehicle. While the former group doesn’t care much about the characteristics of their subscription vehicle, the latter group tends to want some say in the vehicle’s configuration and expects a customer journey that’s similar to the traditional vehicle purchase journey (e.g., pickup at the dealer, rather than at a rental station). Pricing: Some consumers like to pay a fixed monthly fee for their subscription, while others prefer more flexible payments. 3. The subscription has to be one all-inclusive price. The all-inclusive, fixed monthly rate is certainly popular; more than half of consumers in the US and Germany prefer this payment option, as do 30% of Chinese consumers. But, as mentioned above, a significant share of consumers like having flexibility—and many are willing to pay extra for it. In China, 37% of consumers prefer a fully flexible billing model, while 32% of German consumers and 24% of American consumers prefer this option. Many consumers in all three countries said they’d be willing to pay the equivalent of an extra €66 to €109 per month for flexible features such as the ability to change cars once per quarter or stop the subscription and return the car at any time. 4. Customers’ vehicle preferences are the same for subscriptions and purchases. Consumers appear more willing to branch out with their vehicle choices in a subscription model than they might be if making a traditional purchase. Bain’s survey found that a subscription vehicle plan increases many consumers’ willingness to get a premium brand, a larger car, and/or an electric vehicle—but the majority still prefer a brand they know well. 5. Car manufacturers will dominate the market for car subscriptions. In reality, the race appears to be wide open, though the winners might vary by geography. Many consumers do prefer a subscription to a single car brand: 41% of consumers in China, 40% in the US, and 32% in Germany. That bodes well for automakers’ subscription services. But there’s still plenty of opportunity for rental companies and vehicle subscription start-ups. They’re quickly developing subscription plans offering more vehicle-switching flexibility, and they have the ability to price their plans aggressively to grab market share. One of the overarching takeaways from these five misconceptions is car subscription providers will likely take a page out of the telecommunications playbook: The leading providers will develop a deep understanding of the different needs of their target customer segments and will offer a range of different vehicle subscription contract types to appeal to all groups. Finding the right model What’s a good starting place for companies that want to adjust their car subscription models in light of these misconceptions? While there’s a long list of potential business models, three primary ones have emerged (see Figure 3). These models vary based on the level of flexibility in the subscription contract and the number of brands offered. We believe these three will gain the most traction in the coming years because they improve the service providers’ economics while still catering to customers’ preferences. Of course, landing on the right features of a vehicle subscription model is only step one. The emerging leaders in this field are also designing and executing their programs differently, in four strategic areas. They’re avoiding subscription service pitfalls. Leaders sidestep common mistakes in service design and delivery in part by catering to differences in customer preferences among markets, car segments, and age groups. This might favor offering variations of subscription services. They’re sharpening critical operational capabilities. Although the emerging subscription business models offer a clearer path to profitability, each one still requires the provider to consistently execute in key areas in order to succeed. These capabilities include dynamic pricing; high-quality customer service; strong digital tools; a well-defined marketing plan to compete with traditional automotive purchase models and channels; and sourcing, owning, and moving inventory to deliver the right vehicles at the right place and time. They’re steering customers toward used cars and electric vehicles. Based on consumer interest in the Bain survey, subscription services could be a gateway to marketing used cars and battery-electric vehicles. They’re involving dealers and partners. Leaders avoid competition with dealers and seek opportunities to work with partners to deliver the subscription service efficiently. For example, automakers might form partnerships with rental companies. Getting a lift After years of vehicle subscription services not reaching their full potential, the pandemic has opened a window for companies to rethink these services. It’s unclear how big of a market this new wave of subscription services will create. But if companies design and execute them well, they can turn into profitable enterprises that provide a meaningful lift to the rest of the business. Executives looking to transform their car subscription service can start by asking themselves the following questions: What percentage of our company’s total annual revenue do we aim to sell via this new channel? Which target customers do we plan to serve (e.g., existing vs. new, older vs. younger)? Which subscription business model makes the most sense for our company, based on our current product portfolio, operational capabilities, and brand strength? Which operational capabilities do we need to strengthen in order to build a successful subscription service? How should we prioritize and invest in those capabilities? What’s the long-term vision for how our subscription service fits into our product portfolio and overall value proposition? The authors would like to thank Bain Senior Manager Michael Höning for his very valuable contributions and support. https://www.bain.com/insights/car-subscription-services-2-0-how-to-win-the-race/

Car Subscription Services 2.0: How to Win the Race

4 years ago

Share

You may also like

-

Electric Cars Could Save Ride-Sharing Drivers $5,200 a Year

-

Waymo starts to eclipse Uber in race to self-driving taxis

-

Driving in US Costs More than in Parts of Europe

-

Mercedes-Benz's Plan for Surviving the Auto Revolution

-

Self-Driving Car Pioneers Are Slowing Down After Crashes

-

Clean Disruption of Energy and Transportation - CWA - Boulder, April 9, 2018

-

Driverless car startup Drive.ai is launching a ride-hailing service in Texas

-

Cleantech Investors Should Put Their Money in Transportation, Says Village Capital

-

Car companies have started offering monthly subscriptions for drivers who don't want to own

-

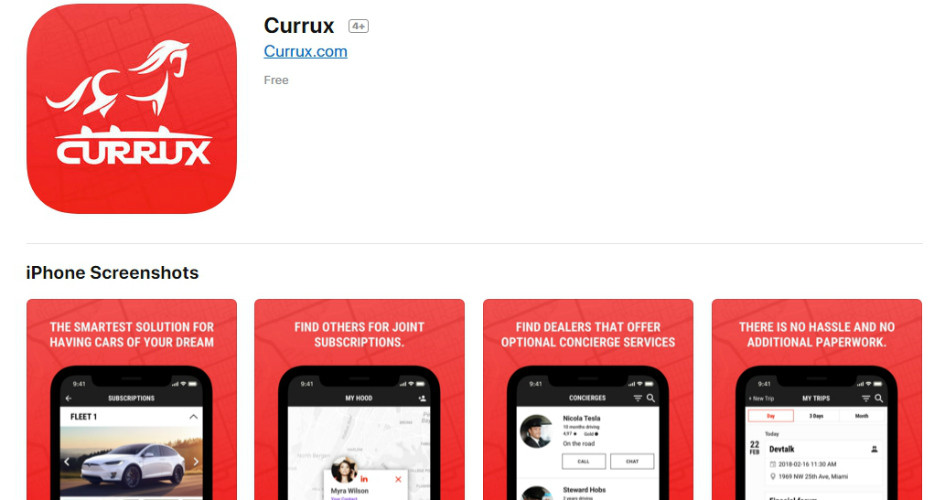

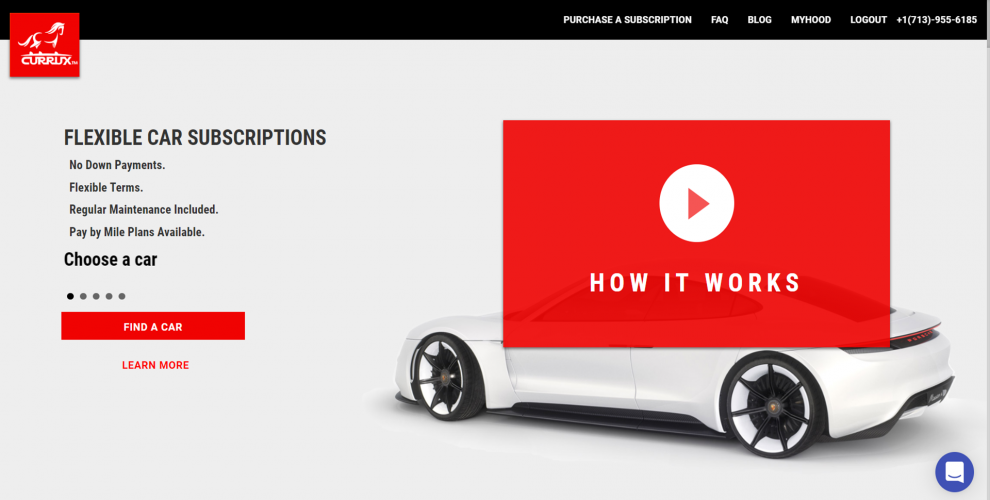

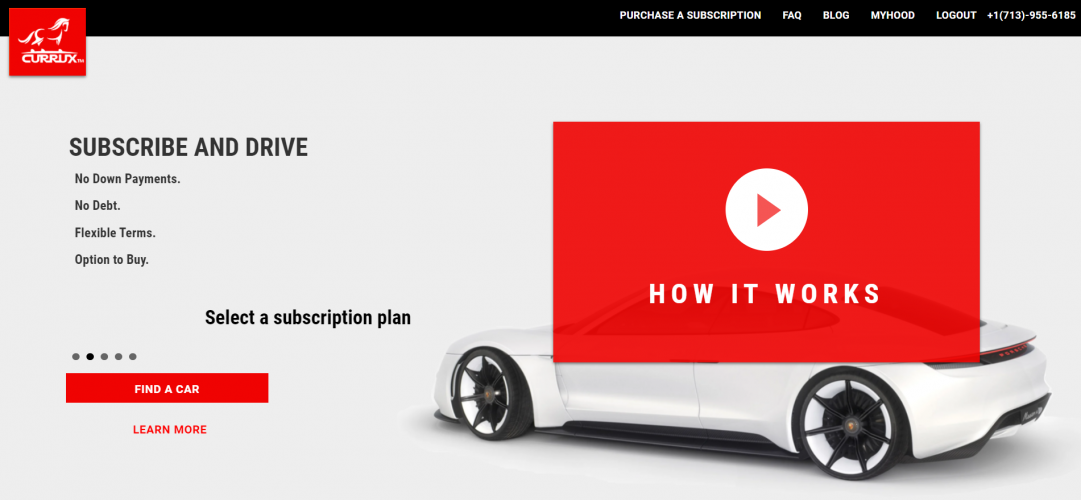

Introduction to Car Subscriptions / Currux

-

Currux App is Coming!

-

On Shared Car Subscriptions, the Power of Compound Interest and Currux

-

Currux App is now available on Google Play!

-

Mary Barra on Driving Into the Future

-

Currux – a case for a decentralized fleet management / mobility future.

-

Currux App Is Now Available on Apple App Store!

-

GM Gets Ready for a Post-Car Future

-

Currux - Interview with the developer of a fantastic app

-

Volvo targets 33% autonomous sales and 50% subscription sales by 2025

-

Why Buy a Car When You Can Subscribe in Style?

-

State bill would put car dealers in driver's seat for newfangled subscription services

-

Toyota Launches a Car-Sharing Subscription Service for Hawaii

-

New Age of Transportation Expected to Thin Auto Dealer Ranks

-

Car subscription services offer simple, flexible alternative to buying or leasing a car

-

Like Netflix or Amazon Prime for cars: St. Louis dealers look to lure customers with monthly subscriptions

-

Version 3 of Currux App Published in App and Play stores.

-

Riding Uber & Lyft More Expensive than Subscribing with Currux

-

This is What You Need to Know About Car Subscriptions

-

Monthly car subscriptions pick up speed with drivers

-

Increased Consumer Awareness of Depreciation Costs to Boost Subscriptions

-

With Audi Select, Automaker Pilots Subscription Rentals

-

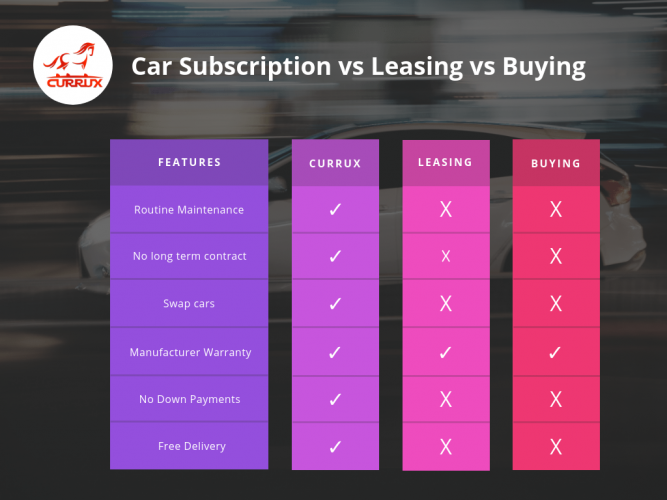

Difference between leasing and car subscriptions

-

Continuous EV Range Increases Will Drive US Shifts To Leasing/Subscriptions & Growth In The Used Car Market

-

Currux Car Subscriptions: 5 Things You Should Know

-

Leasing vs. Buying vs. Car Subscription

-

Audi Approves Mega Spending On Electric Mobility

-

WARMEST WISHES FOR HAPPY HOLIDAYS AND A HAPPY NEW YEAR!

-

One-Click Online Purchasing Is Encouraging More Car Buyers to Ditch the Dealership

-

Car subscription services: A slow, expensive start — but the potential is huge

-

Noteworthy way to get a cheap monthly car rental in Houston

-

This company’s machine learning programs are making driving in Houston safer — and cheaper

-

Eight trends that determine the future of vehicle leasing

-

AMAZON CONFIRMS HUGE INVESTMENT IN EV MAKER RIVIAN

-

COMPLETE GUIDE TO VEHICLE SUBSCRIPTIONS

-

Yes, You Can Lease a Used Car

-

Leasing a Used Car Can Save You Some Serious Bucks

-

Enterprise announces its automobile subscription service

-

Instead of leasing or buying a car, subscribe to one

-

Five ways vehicle subscriptions will impact dealerships by 2020

-

Private and SME Segments Stand Out Globally as Key Targets for Car Leasing Companies

-

Car subscription service Cluno discloses €140M in debt financing

-

Daimler Mobility starts long-term car rental business in Korea

-

Could car subscription services disrupt the auto industry?

-

Currux to Participate at Cleantech Private Capital Day v2 Investor Conference

-

NEWS Toyota launches European mobility brand Kinto

-

The Cruise Origin Story

-

Pay to play: Car-subscription programs on the rise

-

Used Car Leasing on Course To Becoming A $6B Market (And That’s Just In Europe)

-

Penske Offers Truck Fleets a "Get Back to Business" Special Offer with Flexible Lease Terms

-

OEM Transformations: The Benefits of Subscription Models

-

UK’s Drover raises $26M to take its car subscription marketplace to Europe

-

Those Vehicle-Swap Schemes Seemed Like a Good Idea

-

It's still Day 1 for vehicle subscriptions

-

Why OEMs Won’t Survive Transition to Mobility

-

Investors Are Eyeing Mobility Technologies, and for Good Reason

-

Edmunds: Whatever happened to car subscription services?

-

Tesla finally offers lease-to-buy options for Model 3 and Y, but it’s not available everywhere

-

Porsche adds the all-electric Taycan to its subscription program

-

Will The Shift To Electric Vehicles Change The Car Subscription Market?

-

Volkswagen Explores Customer Interest In Subscription Model

-

Currux featured as one of 22 Best Texas Based Consumer Lending Firms

-

Currux Review – Complete Review

-

Car subscription: a multi-billion Euro market!

-

Car Subscription Services 2.0: How to Win the Race

-

EVs and autonomy: Why it will make no sense to buy your own electric car

-

What is a car subscription service?

-

Autonomy’s Electric Vehicle Subscription Now Available in California’s Napa, Sonoma, and Marin Counties

-

Germans lead EV buyer intentions poll

-

Car subscriptions entering the vehicle market: What you need to know