Are you thinking about leasing a new car? It may be possible to lease a slightly used version of the same vehicle you've got your eye on and save yourself thousands of dollars in the process. If you've never heard of a used-car lease, don't worry. Most people haven't.

Used-car leases are a bit of a secret. Not all dealers offer them, and it's unlikely you'll see them advertised online or elsewhere. Even people who work at car dealerships may be unaware that leasing a used car is an option.

But used-car leases do indeed exist, and for shoppers willing to do the legwork to land one, the reward may be more than just savings. Because used-car lease savings can be so significant, shoppers may be able to afford a nicer car and still save money compared to leasing a new vehicle.

How Does Used-Car Leasing Work?

As a rule, used cars available for lease from dealerships will be certified pre-owned (CPO) vehicles that are less than 4 years old and with fewer than 48,000 miles on the odometer.

Used-car leases follow the same basic structure as new leases. The lender will determine the vehicle's residual value and determine the payments based on the difference between the vehicle's sales price and its residual value. Not all automobiles depreciate at the same rate, so the residual values vary. In most cases, the lender will be an automaker's "captive" financing company: Think Toyota Financial at a Toyota dealer.

The lender writing the lease will assign the deal a money factor, which is, essentially, the interest rate. That's the same as a regular lease. And just as interest rates tend to be higher on used-car loans, the money factor will likely be higher than in a new-car lease. Even so, the higher money factor is coupled with a lower sales price and a lower rate of depreciation, usually resulting in a lower overall payment. Shoppers who lease used are able to buy out the vehicle at the end of the lease, just as they can with new autos.

During my 12 years of selling and leasing autos, I saw buyers shave anywhere from $40 to $125 per month off their monthly payments by leasing used. I worked in dealerships that sold regular, everyday vehicles. People looking to lease used luxury cars may see larger savings.

A note of caution: You may hear about used leases from independent "Buy Here, Pay Here" dealers. Such leases frequently come with lots of strings attached, and you should scrutinize the terms very carefully. Also, specialty car lots that deal in exotic, ultra-luxury or classic vehicles may offer in-house used-car leases.

Primarily, this story deals with used leasing as handled by franchised dealers. They are the only ones that can offer true certified pre-owned automobiles.

How to Do It, Step by Step

Call the lender: If you've got your eye on a vehicle from a particular carmaker, try placing a call to the captive lender of that brand and asking if it offers leases on used certified pre-owned vehicles. You should be able to find the customer service number by searching the brand's name followed by "finance phone number." For example, a shopper hoping to lease a used Toyota Camry would call Toyota Financial.

Have a point of comparison: To effectively judge if a used-car lease is a good value, you have to have something to compare it to. If you don't already have a lease quote for a new version of the auto you want, get one. With that benchmark in hand, you can start shopping for a used-car lease.

Find the car: Edmunds has plenty of tools to help you find the right used car. Search for the model you're most interested in and remember to home in on certified pre-owned vehicles. Because you are shopping in the used market, you may not readily find your preferred color combination or mix of features. Be flexible. Select a few from different dealers. That way, if the first one isn't able to help, you'll have other choices.

Find a dealer who'll do the deal: Since used-vehicle leasing is not the norm, finding a dealership that can help you will likely take some time and patience. You may have to call a few to find one that can do these lease deals.

When you find a vehicle you like, call and speak with an internet manager or sales manager. Say that you've found a certified pre-owned car in inventory and you'd like to know if you can lease it. If you get a quick "No," don't be afraid to ask the manager to check with a higher-up to confirm. Since used leases are still relatively rare, the person you talk to may not know that it's an option. Don't be surprised if the manager says that he'll need to call you back.

If you don't get anywhere, move to the next option on your list.

Get a price quote: Once you find a dealership that is set up to offer used-vehicle leases, ask for a price quote. All the standard shopping rules apply: Negotiate a fair purchase price using the Edmunds appraisal calculator, which will show you a dealer's retail CPO value. Get the residual value in the event you'd like to buy the vehicle at the end of the lease. Finally, determine the total down payment and total monthly payment, including taxes and fees.

Compare again: Check the used-car lease's price against the new one. If the savings are good, it might be time to set up a test drive and maybe even make your deal.

Pros of Used-Car Leasing

Lower monthly payment: Just to recap this major point: The CPO vehicle has a lower selling price than its new-car counterpart, and because of that, you avoid the steep new-car depreciation curve. These two elements combine to produce a lower monthly lease payment even with a higher money factor.

Good candidate for a lease buyout: Since used cars are worth less than comparable brand-new cars, their residual values will be lower too. That makes them good candidates for a buyout at the conclusion of the lease. Just be sure you do your due diligence, checking market prices and factoring in such costs as maintenance and future extended warranty costs that come with buying an older car.

Longer powertrain warranty: A CPO vehicle will typically have a powertrain warranty that runs to 100,000 miles. That's potentially a significant plus for shoppers who plan on purchasing the vehicle when the lease ends.

Potentially lower auto insurance costs: Because of the automobile's reduced value, insurance may cost less.

Cons of Used-Car Leasing

In addition to the extra legwork it takes to set up a used-car lease, consider:

Maintenance costs: By leasing a car that already has miles on the odometer, expect maintenance visits to occur sooner than you'd experience in a new car. Count on higher upkeep costs.

No new-car smell: The car will be new to you, but it isn't fresh from the factory. Expect to find the occasional scratch, stain or ding.

May not have latest features: A brand-new, current model-year vehicle may have safety or technology features that an older version may not. If you decide to lease a certified pre-owned car, make sure it has all the bells and whistles you need.

Other Used-Car Lease Options

Swapalease and LeaseTrader are websites that allow people who are looking for a deal to take over the lease of a person who is currently in a lease but wants out.

Because the current owner of the vehicle has likely already made a down payment to start the lease, a person assuming the lease wouldn't need to. In some cases, a person desperate to get out of the current lease will even offer a cash incentive to the new owner.

Factoring the low pocket expense and potential cash incentive, taking over someone's used lease can also be a way to save money.

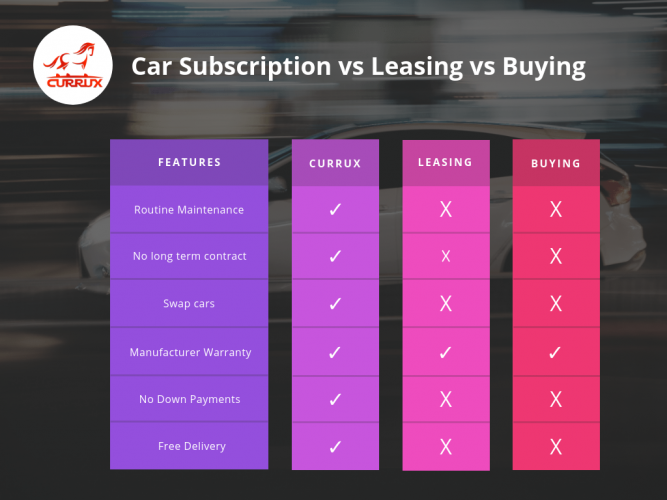

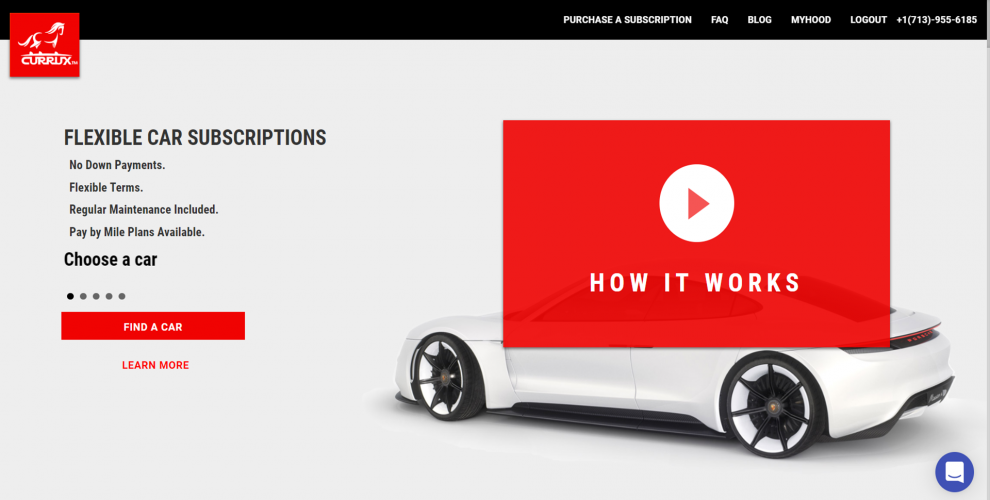

Used-Car Subscription Services

Although these companies don't describe their products as leases, Fair and Canvas allow people to subscribe to used vehicles. Like traditional leases, startup costs are low, there are mileage limits, and monthly payments will tend to be lower than that of a comparable purchase. Unlike leases, there is no option to purchase the vehicle when you are done subscribing to it. Also, unlike leases, these subscription services will include routine maintenance, and in the case of Canvas, the monthly payment will include full-coverage auto insurance.

Gaining in Popularity

For the last several years, traditional new-car leases have made up about 30 percent of all finance transactions at new-car dealerships. Most of these automobiles will find their way back as lease returns after a few years. Dealers will look for ways to offload them, including expanding used-car leases, according to those dealerships that are already offering these leases on their lots.

Not a Magic Bullet

Used-car leases aren't the only option for budget-minded shoppers. Because of aggressive incentives on some new vehicles, including cash-back rebates, lower money factors or end-of-model-year incentives, leasing a new vehicle might be a better deal than leasing a used car that's just a couple of years old.

But let's say you want to lease a car that doesn't have a crazy special on it — perhaps because it's a hot seller that doesn't need any factory incentives to move it off the dealer's lot. In that case, leasing a used version can be a nice way to get a car that's very close to what you want for a lot less cash.