October 28th, 2018 by Loren McDonald

Electric vehicles with bigger or more efficient battery packs every few years will be key to meeting the longer range (300 to 400+ miles) expectations of many US consumers. But these continuous upgrades will also create challenges and opportunities for auto industry participants.

In part 1 of this series, I shared my new analysis and forecast that the average range of BEVs available in the US by 2022 will be around 275 miles and could reach about 400 miles by 2028. With solid-state batteries expected to be installed in EVs in the late 2020s, we could also see several new EVs with 500 miles of range.

These expected regular battery upgrades are obviously great news for consumers who will be able to purchase both new and used EVs with increasingly longer ranges — and at lower price points. But these increases in range every few years could also drive 3 significant auto industry trends:

- Higher depreciation/lower residual value of EVs (as compared to similar gas/diesel vehicles — until gas/diesel vehicles lose their value because the market has shifted to EVs).

- A broader shift to leasing and subscription models.

- A significant increase in consumer preference to buy used versus new cars.

Higher Depreciation/Lower Residual Value of EVs (for now): According to Kelley Blue Book, the base 2015 Nissan Leaf S starts at about $30,000 and increases to about $33,000 for the mid-level SV, and about $36,000 for the top-line SL. A quick sampling of used 2015 LEAFs shows a typical price of about $11,000. In essence, within 3 years, the LEAF is only worth one-third of its new-car price.

On average, a new car will lose 60% of its total value over the first five years of its life, according to CarFax. In the example of the 2015 LEAF with a purchase price of $33,000 and used price 3 years later of $11,000, it lost 67% of its value in only 3 years.

In the above chart from Bloomberg using data from Kelley Blue Book, electric cars have the lowest expected residual value after 36 months across all types of passenger vehicles in the US.

Source: iSeeCars.com study

Source: iSeeCars.com study

Similarly, recent analysis from iSeeCars.com found that the Nissan LEAF and Chevrolet Volt had the highest average 5-year depreciation of US vehicles. (Note: The Tesla Model S had a more respectable 57.3% average depreciation.)

“Government incentives play a role in the steep depreciation of electric and plug-in hybrid vehicles as their resale value is based off their lower effective post-incentive sticker price. Since the technology of EVs changes at a rapid pace, outdated technology also contributes to their dramatic depreciation as well as range anxiety and lack of public charging infrastructure.” — Phong Ly, CEO, iSeeCars.com

While these are averages and there are many variables that go into the value of a used EV, I assume that at least for the near future, EVs, especially those with below-average battery range, are likely to depreciate at higher rates than most gasoline/diesel vehicles and EVs with longer ranges.

Shift to Leasing and Subscription Models: In the US, approximately 70% of all new vehicles are purchased versus 30% being leased. However, 80% (according to Bloomberg New Energy Finance) of all BEVs (except Tesla, which does not disclose lease versus purchase numbers) are currently leased.

US Vehicles Lease Versus Purchase Rate | Source: Statista

US Vehicles Lease Versus Purchase Rate | Source: Statista

EVs cost more than similar gasoline/diesel models, leading to a higher number of people choosing to lease because of the lower monthly payments versus that of a loan. But another key reason is due to technology obsolescence because buyers know that in 2–3 years a potentially significantly better EV will be available for the same or less cost.

Similar to trading up for a new smartphone, many consumers will increasingly want to upgrade to the latest EV with longer range, better software, faster charging capabilities, more advanced autopilot technology, and other features and bundled services. By upgrading every 2–4 years, consumers will look to shift the car value risk to the auto finance companies, while paying a slight premium for the benefit of increased flexibility and the latest and greatest features. (The Motley Fool article “Why Rising Car Leases Should Worry Automakers“ highlights some of the coming factors and risks to automakers with the shift to leasing.)

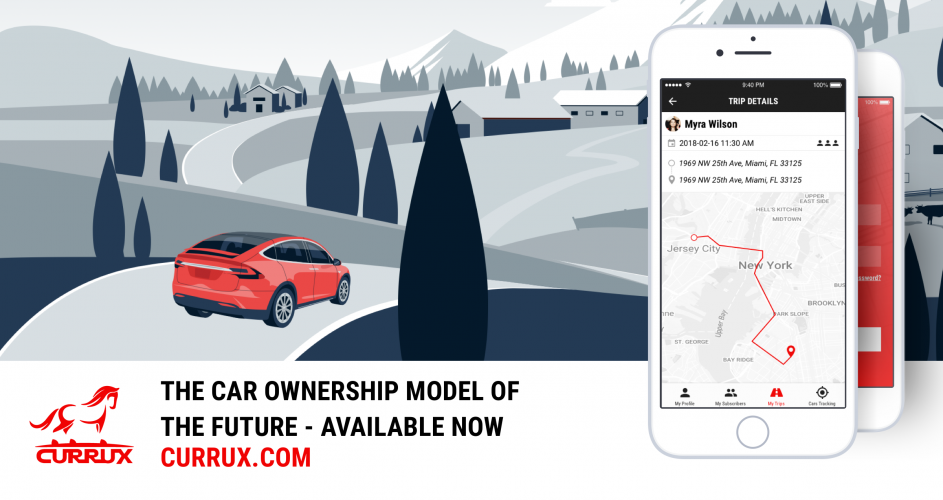

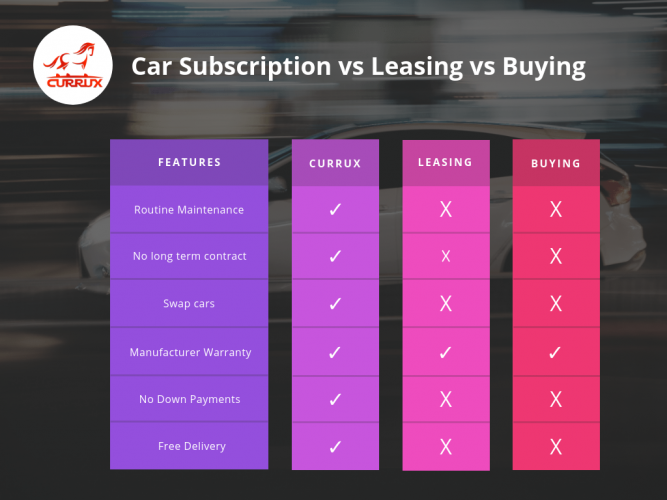

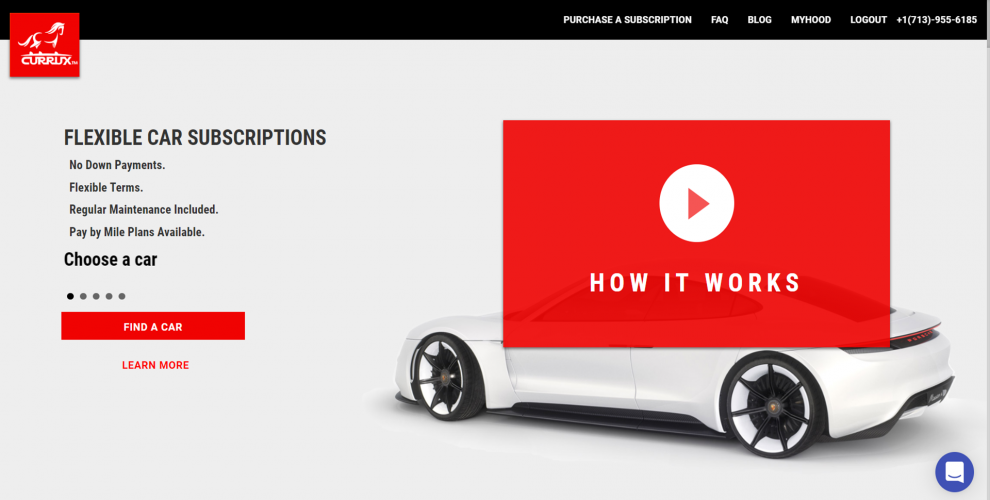

For these and other reasons, we may also see a shift to the subscription model for cars instead of buying or leasing — especially among the luxury carmakers whose customers can more easily afford the premium cost of this approach.

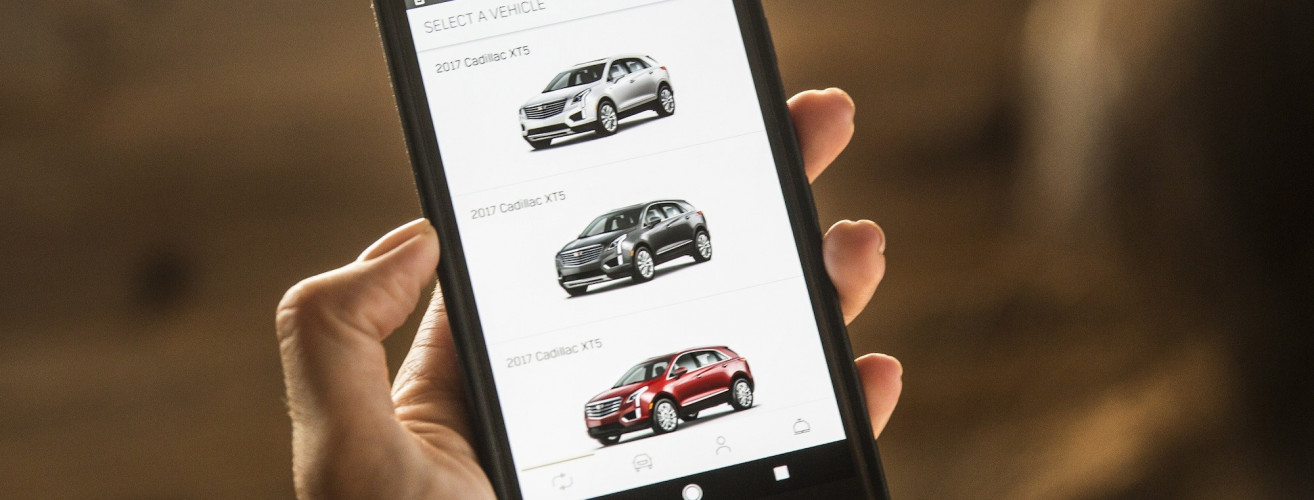

As consumers, we are increasingly accustomed to subscription models — Netflix, computer data and file storage like Dropbox, music services, pre-made meal services, and more. But car subscription services is still a relatively new concept. Luxury brands, however — including BMW, Cadillac, Porsche, Volvo, Lincoln and Mercedes-Benz — have all either launched or are testing or planning subscription services.

Car subscriptions typically include:

- Regular access to your primary vehicle.

- Access to other vehicles, such as SUVs, sports cars, etc. — providing increased flexibility.

- Maintenance, insurance, registration fees, etc.

Increase in Used Car Purchase Rate: The shift to subscriptions and leasing rather than buying EVs means there will be more frequent turnover of cars and value-oriented buyers will be able to buy used EVs at significant discounts. And because buyers can get 3 year old vehicles with advanced technologies and features at significantly reduced prices, I expect a fairly significant shift to consumers opting for used vehicles over new.

Underpinning this shift is also the growing awareness by consumers that electric vehicles have fewer moving parts and will require less maintenance and replacement parts as the vehicles age. The one rub and unknown will be how the fear of needing to replace older battery packs after perhaps 8–10 years affects consumers’ appetite for used EVs. A net result may be a trend of consumers buying 3 year old lease returns, driving them for 3–4 years, selling, and then buying another used EV.

Number of new and used light vehicle sales in the United States from 2010 to 2017 (in millions) | Source: Statista

As EVs are adopted by mainstream consumers, reach price parity with gas/diesel vehicles, and the typical range surpasses 300 miles (of models available in the US), used EVs should hold their value better. The exception to this could be when EVs begin using solid-state battery technology and see significant increases in battery range overnight. This second wave of EV battery range advancement could provide another decline in the value of used EVs.

But at that point in the late 2020s, there will be an inflection point when vehicles powered by internal combustion engines become viewed like standard cell phones versus multi-function smartphones. When this happens, sales and the residual value of gas/diesel vehicles will decline significantly and EVs will hold their value better overall and in comparison to gas/diesel vehicles.